Expert Business Valuations

Business Valuation Specialist in Australia

Whether you are selling or buying a business, thinking about an exit strategy, trying to meet your tax obligations, or publicly listing your company – even if you’re seeking to raise capital or acquire a new partner/associate – knowing your business value is of paramount importance. Both at the outset of your plans, and also throughout the process to ensure you are maximising that value.

Valuations are essential to all an organization’s strategic goals and ambitions. Get it wrong and transparency is undermined, reputations are damaged, transactions or strategic plans can fall over, and the absolute value of your company goes down.

The valuations team at Logic Figures works with clients – primarily from heavy industrial sectors ( Defence, Mining, Minerals Processing, Oil & Gas, Renewables, Agriculture, and Heavy Manufacturing) – on all their valuations needs. We have detailed market knowledge coupled with a deep understanding of the legal and commercial requirements in these valuation processes, and all our Independent Experts Valuation Reports (IEVR) meet ASIC’s scrutiny and our valuation reports meet or exceed the minimum ATO Market Valuation for Tax Purposes Guide and (if applicable) paragraph 5.2 of APES 225.

How to value your business?

No valuation case is the same. We take into account the relevant sector, operational structure, stakeholder expectations as well as long-term strategic plans of the business, and bring together insights gained from many prepared IEVRs.

This experience has meant we can draw on years of expertise to apply our unique and in-depth methodology – and quickly where needed.

Types of valuations

Typical scenarios where a valuation is relevant include:

⇒ Mergers and acquisitions (M&A) transactions

⇒ Business restructuring

⇒ Financial reporting

⇒ Investment analysis

⇒ Management buy-out or buy-in

⇒ Net asset valuations

⇒ Other tax compliance such as capital gains and stamp duty

Get Accurate Business Valuations in Australia

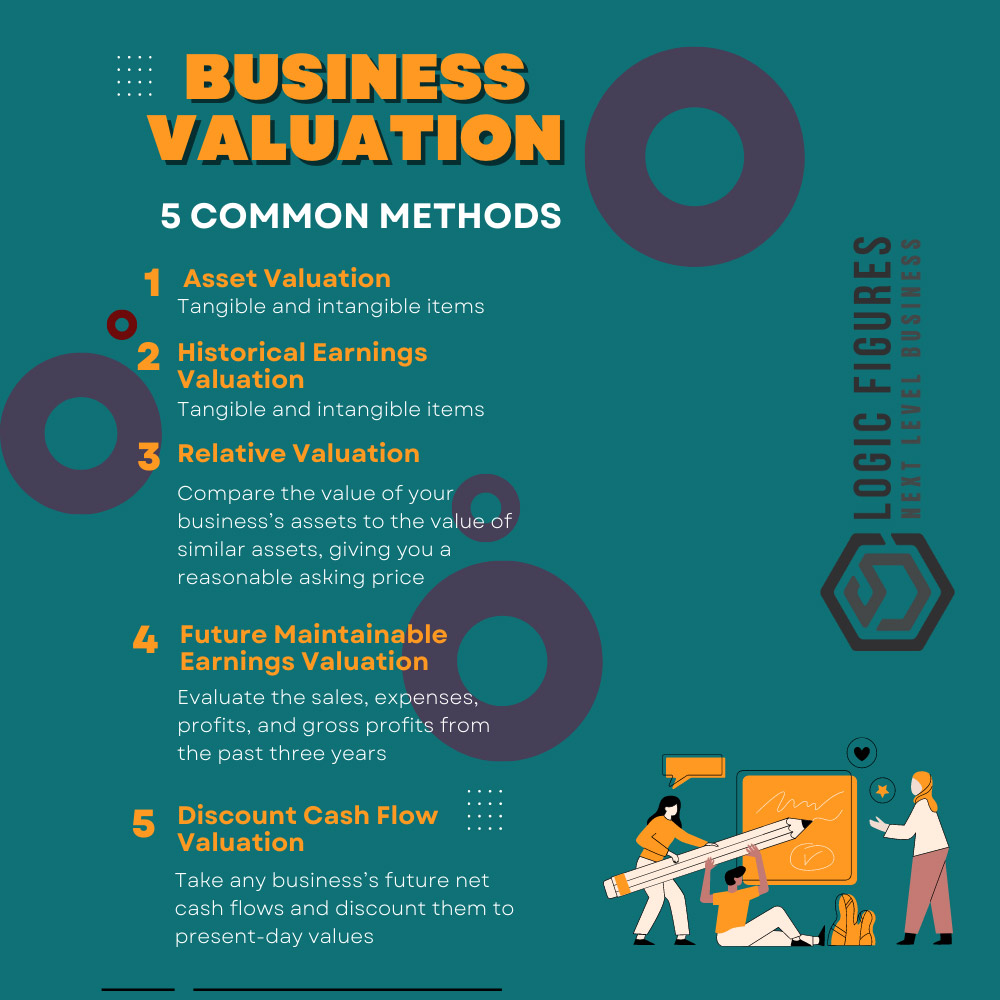

A business valuation is an assessment to calculate the market- value of a business and is calculated by using a set of tools and methods. A business valuation will include comprehensive information about the business.

Logic Figures is a leading advisory and consulting group providing highly detailed valuations for businesses and interested parties in both Australia and US. We only employ accountants and business valuers that individually have more than 25 years of experience in the field.

Logic Figures offers professional business valuations and appraisal services. In addition, we offer Fast Turnaround Times & a minimum of Three-methods Valuations to ensure reliable estimates. Our team of experts provides accurate and reliable assessments for many industrial businesses in Australia.

The valuation process involves gathering information from various sources, including financial statements (tax returns), comparative market analysis and benchmarking, comparative transactions, industry reports, and various conversations with business owners and CEOs to ensure consistent, quality reporting and output. We use all of this information to determine what your company is worth today. This information helps us understand whether it makes economic sense to invest in the company and, if so, at what price. Also, if the timing is right to either acquire or sell a company.

Our expert team will thoroughly investigate your company’s financial health, including cash flow analysis, P&L and balance sheet auditing, and market analysis. We pride ourselves on understanding each of our client’s needs and delivering high-quality results.

Our valuers will assess everything that may impact the value of a business including:

the business’s financial records and accounting books; the industry that the business operates in; forecasted performance of the business for the next 3-5 years; the current market conditions; equivalent business sales; the current economic conditions; the business’s assets for example buildings and operating equipment as well as intangible assets (such as IP); the cost to replace the equipment; the cost to start another equivalent business that can compete with the existing enterprise.

Get An Expert Business Valuation

Logic Figures’ Business Valuers will also review intangible business assets such as the business’s reputation, goodwill, and intellectual property.

Before you buy or sell a business it’s in your best interests to get the business valued so you don’t pay more than it’s worth, or don’t accept an offer that significantly undervalues your business.

Our independent valuers will determine the fair market value based on all available business information and will use various valuation methods (such as assets, DCF, Multiples of EBITDA, trading multiples like P/E, EV/EBITDA, and comparative business deals) and come up with a football field chart summary applying the most appropriate weighting for each method used according to your business type.

So you can trust the value of your (or target) business before initiating a transaction.

If you would like to arrange a business valuation with one of Logic Figures’ Business Valuers, then give us a call at +61 (450) 082-440 (in Australia) or 1 (484) 326-5721 (in the USA)

Please contact us for a guaranteed competitive quote reflecting the value that we provide.

A business valuation is an assessment to calculate a business’s saleable value and is calculated using a set of tools and methods. A business valuation will include comprehensive information about the company.

Download here a sample Business Valuation Report.